It’s the most wonderful time of the year…but it’s also an expensive one for your business and personal life. Purchases here, packages there; your bank account will take quite a few hits over the weeks leading up to Christmas, leaving many people feeling a little overwhelmed as they try to keep track of where their money is going and what has been spent on what.

Online banking is really useful for seeing your outgoings, but at this time of year often a more comprehensive view is beneficial. Take a look at these five tools, which help you track purchases and spending over the holiday season.

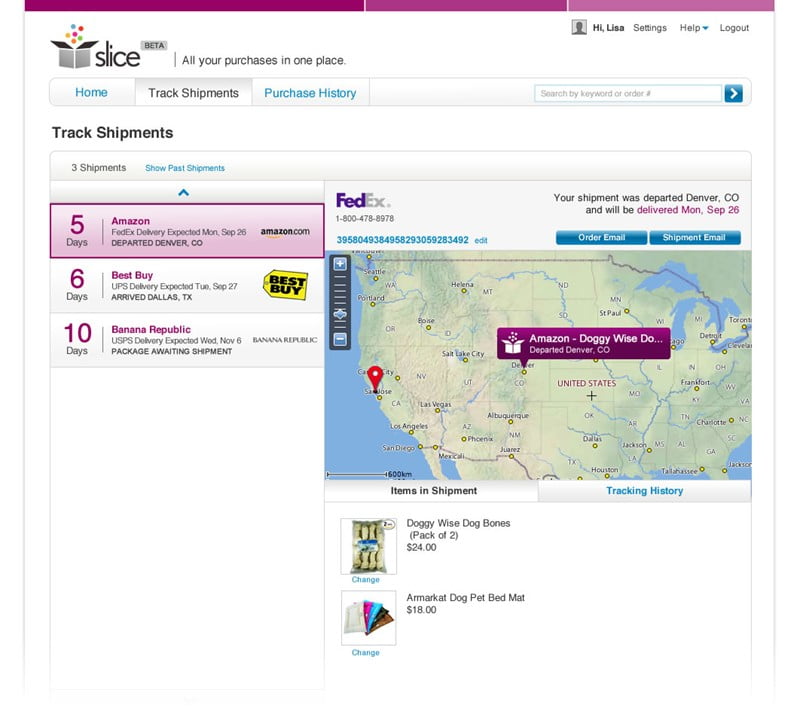

Slice

Slice is an ideal app for the frantic holiday period, a time when packages can arrive at your business and home daily as orders are placed and you await their arrival.

Working with your inbox, it tracks everything you purchase from shipment to delivery at your door, as well as managing your receipts, providing quick-to-access customer service numbers for where you’ve purchased an item, and lets you know when you can ask for a price adjustment.

One of the main features is that it tracks your online spending, giving you a breakdown of where you’ve spent the most money and what categories you’re spending the most on. Waiting for a delivery, but not in at the office to get it? Slice will tell you when it’s on your doorstep. It also provides you with an image of what you’ve purchased, so you can keep track visually of what has been ordered. Free to use.

Mint

An app that has made countless ‘Best’ lists, Mint ticks many a box and more. It is simple to use, clear and makes managing your money a breeze, providing you with a live overview of where your money is going. Linked to your bank accounts securely, it monitors all of your transactions and provides a breakdown of where everything has gone into categories.

It supports you with staying on budget, achieve savings targets and helps you see if you realistically can afford something you’re hoping to buy. You can even get automatic alerts sent to your phone, such as bill reminders. Track all of your Christmas spending – whether for business or personal – and stay on top of it live, knowing exactly what you’ve spent and how much of your budget remains. Not only is it completely secure, it is completely free.

DailyCost

If you’re not too keen on the idea of an app holding on to your bank details and just fancy a simple input-only tool, DailyCost could be ideal. There are set categories available which let you input all of the expenses you spend in a day. These are then organized into graph form which shows you where your money is going. It also keeps tabs on your money over a week and month.

Heading abroad for Christmas? The app has automatic exchange rates so you can still track what you’re spending, no matter where you are. If you’re travelling for business in these weeks leading up to Christmas and are conscious of how much you’re spending, input your daily numbers into the app and know where your money is going. Your app is always protected with a password, and data can be exported to CSV when you need it. $1.99 to buy.

Tricount

Tricount is the perfect app for tracking and calculating groups costs. If you’re a small business owner with a partner or two, Christmas can be a very busy season; taking clients out for drinks to secure a contract in the New Year, a staff gathering, trips to conferences…the costs all add up. When it comes to payment, it often falls down to splitting costs and can get complicated and a little drawn out.

With the Tricount app, group expenses can be created that tracks spending by each person. Even if you’re all at separate events but want to ensure the spending for everything is equally paid, the app will tell you who owes what from the overall balance. When a final breakdown is created, the app will send everyone a link to review and then pay. Free to use.

Check

With Check, it essentially keeps you in ‘Check’ throughout the year, and can be very valuable over the holiday season. It reminds you when payments are due (handy for credit card payment dates), and also lets you pay there and then with a bank account, or schedule a payment for the future. It saves you any late fees, and prevents the use of overdrafts because you are always in control of what’s heading in and out with a clear visual of what’s happening in your accounts.

Manage multiple accounts or cards? A bill too many? This makes it easy to miss things, but the app keeps you on track, with everything in one place. Their app has ‘triple layer security’ so your data is always protected. Free to use, you’ll be glad you have this with you this Christmas.